2025 Irs Contribution Limits Chart

2025 Irs Contribution Limits Chart. Other changes in 2025 include: The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

$7,000 if you’re younger than age 50. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

For 2023, The Maximum Contribution Amounts Were $22,500 And $7,500 For.

Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs.

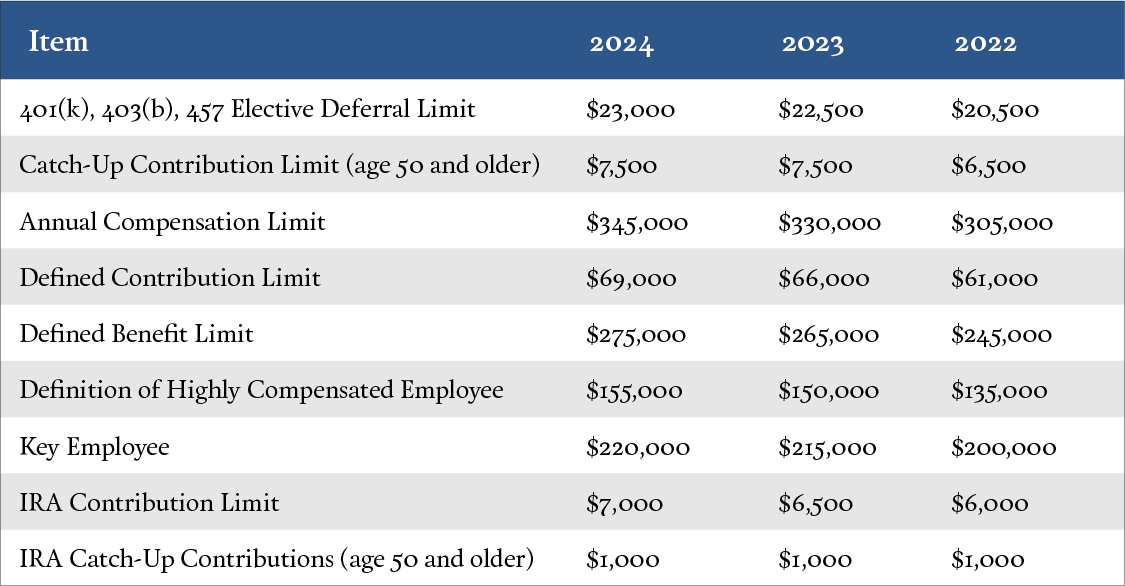

See The Chart Below For Further Details.

The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Workers Age 50 Or Older Can.

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2025 Contribution Limits Announced by the IRS, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2025 (compare that. The maximum contribution limit for roth and traditional iras for 2025 is:

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2025 Charitable Contribution Limits Irs Linea Petunia, The irs released new limits for retirement contributions for 2025. 2025 simple ira contribution limits.

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2025 Perry Brigitta, All new limits will go into. 1, 2025, the following limits apply:

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2025 IRA Contribution Limits, $23,000 for 401(k) plans, $7,000 for iras cnbc | nov 2023 irs bumps 2025 401(k) contribution limit to $23,000. The maximum contribution limit for both types of.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Irs announces 2025 retirement account contribution limits: $8,000 if you're age 50 or older.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2025 Charitable Contribution Limits Irs Linea Petunia, Additional highlights for 2025 the limit on annual contributions to an ira increased to $7,000 (up. Defined benefit plan benefit limits;

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, The limit for individuals to contribute to their simple ira or a simple 401 (k) has increased from $15,500 in 2023 to $16,000 in 2025. Defined benefit plan benefit limits;

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, Other changes in 2025 include: For 2025, there is a $150 increase to the contribution limit for these accounts.

Source: dp457b.com

Source: dp457b.com

2025 IRS Contribution Limits — DecisionPoint Financial, Additional changes to 2025 contribution limits. $77,000 to $87,000 for single taxpayers;.

Source: onidaqiolanthe.pages.dev

Source: onidaqiolanthe.pages.dev

Simple Irs Contribution Limits 2025 Dore Nancey, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. Additional changes to 2025 contribution limits.

The Annual Contribution Limit For A Traditional Ira In 2023 Was $6,500 Or Your Taxable Income.

Additional changes to 2025 contribution limits.

An Employee Who Chooses To Participate In An Fsa Can Contribute Up To $3,200 Through.

See the chart below for further details.